Wealth Management - Questions

Little Known Facts About Wealth Management.

Table of ContentsWealth Management Things To Know Before You Get ThisWealth Management for BeginnersExamine This Report about Wealth ManagementThe 10-Second Trick For Wealth ManagementThe Of Wealth Management

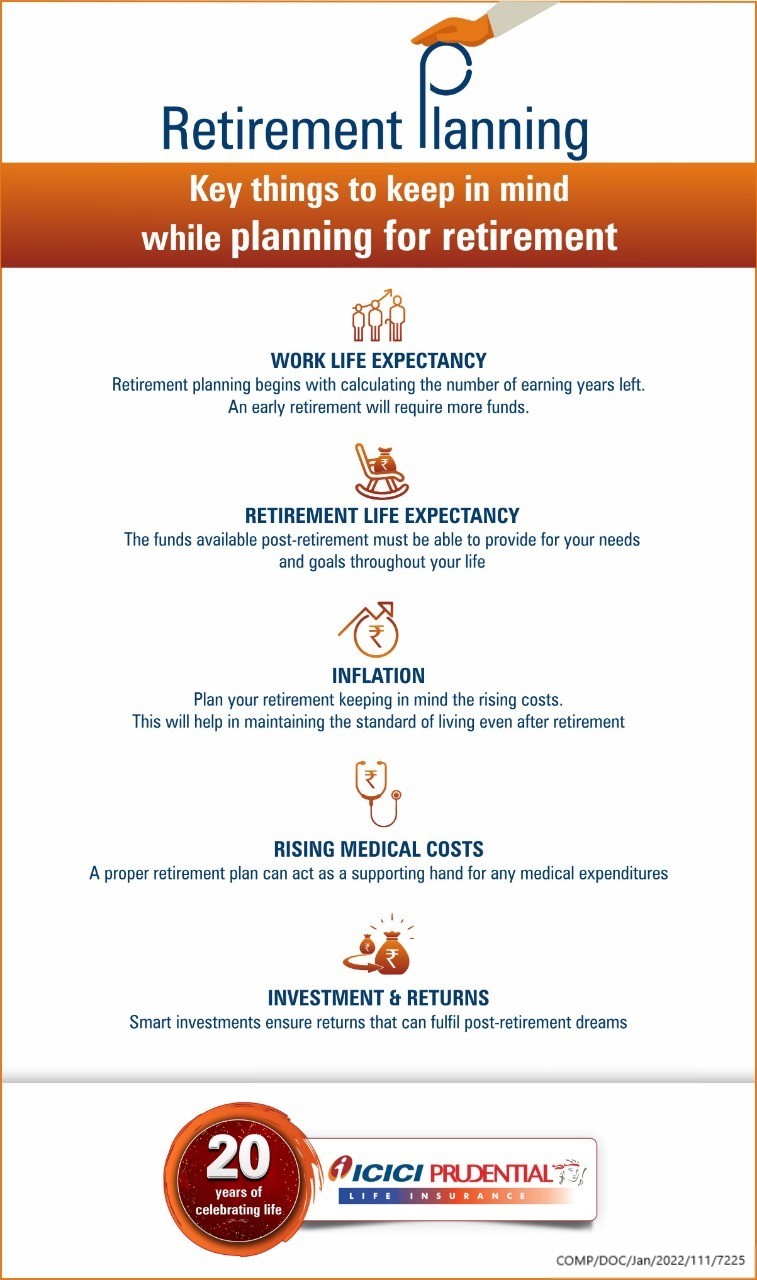

The non-financial elements consist of lifestyle selections such as how to spend time in retirement, where to live, and also when to stop functioning completely, to name a few things. An alternative strategy to retirement planning thinks about all these locations. The emphasis that puts on retired life preparation modifications at various phases of life.

Others say most retired people aren't conserving anywhere near enough to fulfill those standards and also ought to readjust their way of life to survive what they have. While the quantity of cash you'll wish to have in your nest egg is necessary, it's additionally a great concept to consider all of your expenditures.

Not known Factual Statements About Wealth Management

And because you'll have extra complimentary time on your hands, you might likewise desire to factor in the cost of entertainment as well as traveling. While it may be tough to come up with concrete numbers, be certain to come up with a sensible estimate so there are not a surprises in the future.

No matter where you remain in life, there are numerous essential steps that apply to virtually every person throughout their retired life planning. The following are several of the most typical: Generate a plan. This includes choosing when you desire to start saving, when you want to retire, as well as how much you wish to save for your best objective.

Check on your investments from time to time as well as make periodic modifications. Retirement accounts come in numerous shapes and sizes.

You can and also ought to contribute greater than the quantity that will certainly earn the company match. As a matter of fact, some experts suggest upwards of 10%. For the 2023 tax obligation year, individuals under age 50 can add as much as $22,500 of their profits to a 401( k) or 403( b) (up from $20,500 for 2022), several of which may be furthermore matched by an employer. wealth management.

Top Guidelines Of Wealth Management

This suggests that the cash you conserve is deducted from your income before your taxes are taken out. It decreases your taxable earnings and also, consequently, your tax obligation responsibility.

So when it comes time to take circulations from the account, you undergo your typical tax obligation rate back then. Remember, though, that the money expands on a tax-deferred basis. There are no funding gains or reward tax obligations that are assessed on the equilibrium of your account up until you begin making withdrawals.

Roth IRAs have some constraints. The payment limit for either individual retirement account (Roth or standard) is $6,500 a year, or $7,500 if you are over Visit Your URL age 50. Still, a Roth has some revenue limitations: A solitary filer can contribute the complete quantity just if they make $129,000 or much less annually, since the 2022 tax obligation year, and also $138,000 in 2023.

Rumored Buzz on Wealth Management

The EASY IRA is a pension offered to staff members of local business instead of the 401( k), which is expensive to maintain. It functions the exact same means a 401( k) does, permitting employees to conserve money automatically via payroll reductions with the alternative of an employer suit. This amount is topped at 3% of a staff member's annual wage.

Catch-up contributions of $3,500 enable employees 50 or older to bump that limitation as much as $19,000. As soon as you established a pension, the concern becomes just how to direct the funds. For those intimidated by the supply market, consider spending in an index fund that needs little upkeep, as it merely mirrors a stock market index like the Requirement & Poor's 500.

Below are some standards for successful retirement planning at various phases of your life., which is an essential and also useful piece of retirement savings.

Also if you can just deposit $50 a month, it will deserve three times much more if you invest it at age 25 than if you wait to begin spending up until age 45, many thanks to the happiness of compounding. You may be able to spend even more money in the future, however you'll never have the ability to make up for any click for more info kind of lost time.

The 9-Minute Rule for Wealth Management

Nevertheless, it's important to continue saving at this stage of retirement preparation. The mix of making even more cash and also the time you still need to invest and gain interest makes these years a few of the ideal for aggressive cost savings. Individuals at this phase of retired life preparation ought to remain to make use of any 401( k) matching programs that their companies use.